WHAT ARE STABLECOINS

You may have seen stablecoins plastered all across the news in recent weeks and there is good reason. The Terra project UST de-pegged and quickly unwound into a death spiral from $1 to basically nothing in just a few short days, taking along about US$20 Billion with it. So what is a stablecoin, what is it supposed to do and are some stable coins more stable than others? In this short and informative post we will explain what are stablecoins.

Stablecoins are a type of cryptocurrency whose value is meant to correlate directly (pegged to) a fiat currency. Stable coins can be in US dollars, UK pounds, Euros or, theoretically, any currency.

USE FOR STABLECOINS

Their value is manifold. Firstly, they provide a convenient way to exit a crypto position and store your value in the fiat currency that you use in everyday life, perhaps in times of market volatility. Their second use is for convenience. When you sell cryptocurrency you don’t necessarily want to go through the expense and hassle of getting fiat currency in cash or via a bank. Stable coins offer you the safety of the fiat you need, without the obligation to take your money out of the digital cryptocurrency ecosystem. Thirdly, they can be paired with many different crypto currencies so they are a convenient trading partner on exchanges.

Most large exchanges will offer trading pairs with altcoins to both BTC and several choices of stablecoins. If you wish to buy stablecoins, then you may simply to go FTX CRYPTO EXCHANGE for a good range of stablecoins with low fees. If you need to know How to Join FTX CRYPTO EXCHANGE then you may view our simple guide HERE.

So, we can see a use case for stablecoins, but are all stablecoins created equally? The answer is no, they are not. There are basically 4 types of stablecoin, each with particular strengths and weaknesses.

- Fiat-backed Stablecoins

- Commodity-backed Stablecoins

- Cryptocurrency-backed Stablecoins

- Algorithmic Stablecoinsb

DIFFERENT TYPES OF STABLECOINS

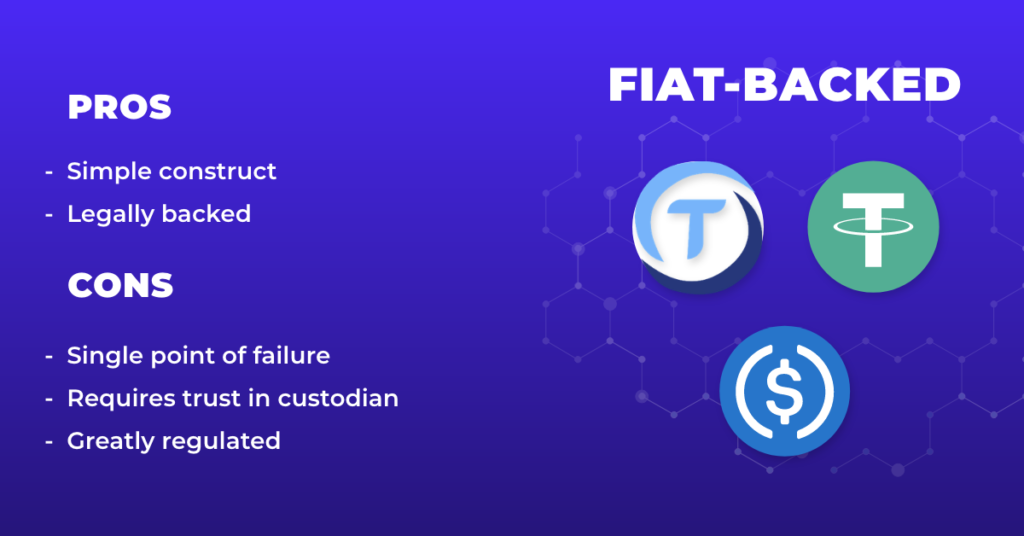

1. Fiat-backed Stablecoins

These coins are backed by the fiat currency on a one to one ratio. If you have one dollar of the stablecoin, there is one real dollar to back it up. This real dollar is stored in a bank account or under a mattress and is, or rather should be, readily available to those who wish to see it. Tether (USDT) and USDC are this type of stablecoin. They claim to have full war chests of real dollars that equate to the total number of stablecoins in circulation. USDC claims that its cryptocurrency is backed by U.S. dollar-denominated assets held at regulated and audited U.S. financial institutions. USDT is the third largest cryptocurrency by marketcap and hold around $65 Billion worth of the token, this is by far the most popular stablecoin today.

2. Commodity-backed Stablecoins

These coins are backed, as the name suggests, by commodities. One such is Tether Gold (XAUT). This is backed by one troy ounce of gold. If you own this coin you will be able to cash it in for an ounce of gold. The gold is reported to be held in Switzerland and can be shipped to you in that country if you choose to redeem your token. Outside of Switzerland you will need to pay for extra security for your shipping. XAUT’s price does seem to have accurately reflected the gold price since inception. If you like gold, then this may be a sensible option for digitally holding some.

The first two types of stable coins are fairly easy to understand. The next two are not so easily comprehended.

3. Cryptocurrency-backed Stablecoins

These are stablecoins issued against the value of another cryptocurrency. To avoid the volatility associated with crypto they will over-collateralize the matched crypto pair. For example you might be given 500 dollars worth of the coin for locking up 1000 dollars worth of Ethereum. However, if Ethereum loses its value, your coins may quickly become worthless. This is an automatic process. Cryptocurrency backed stablecoins have value in that they are decentralized and can be trustless. Be aware though, that they are quite a complex entity and not really for the beginner to dabble in. Dai (DAI) is one such project. By relatively complex mechanisms of buying and selling crypto assets and issuing DAI the peg to the US dollar is maintained. DAI has managed to maintain an accurate peg since its inception.

4. Algorithmic Stablecoins

Algorithmic stablecoins, utilize complex algorithms to control the stablecoin’s supply. In some ways this is similar to a central bank’s approach to printing and destroying currency. With an algorithmic stablecoin all adjustments are made on-chain and no collateral is required to mint the coin. The value is controlled by supply and demand and the underlying algorithm stabilizes the price. This is most often done in conjunction with a second floating token whose value will rise and fall.

These stable coins are based on market demand and supply and need continual growth to prosper. They are not backed by any collateral and have no intrinsic value (collateral) – even claimed. Having said that, some of them are a mix of collateral and algorithmic mechanisms. This may make them a better bet than ones that only have algorithmic mechanisms to support their stable coin.

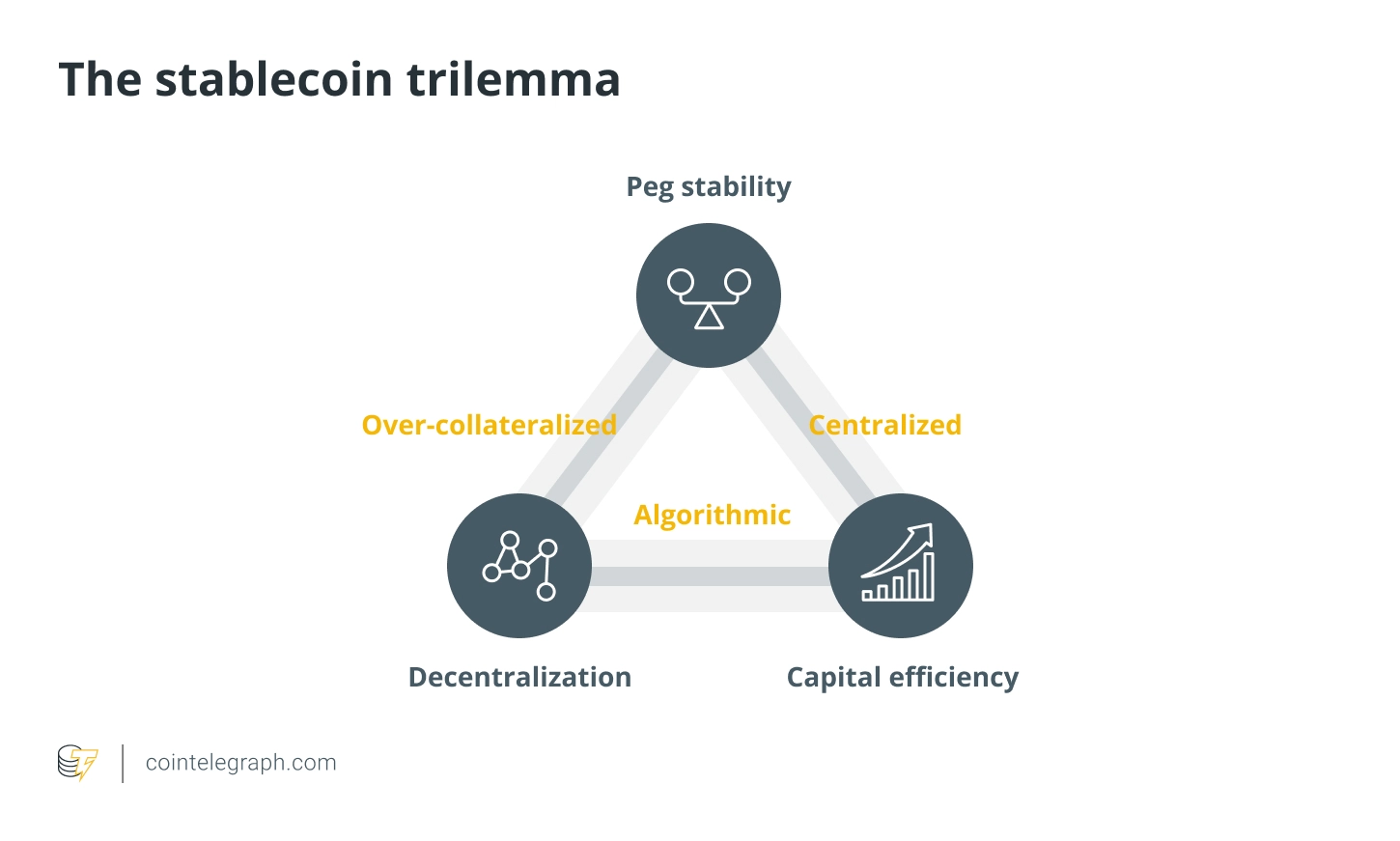

THE STABLECOIN TRILEMMA

Stable coins have a place in a cryptocurrency portfolio. Be aware which type you are investing in. All stablecoins are not all equal, some are more stable than others.

Most stablecoins find themselves faced with the stablecoin trilemma, where a strength in one particular area will cause a weakness in another. Trying to find the delicate balance between maintaining the peg, capital efficiency and decentralization. It would seem to be, that as an emerging technology, it may take some time to get this balance correct. In the meantime tread cautiously.