Ethereum – The Promised Land?

So what exactly is Ethereum and how does it differ from its elder brother Bitcoin?

Ethereum is a decentralized, open-source blockchain with smart contract functionality. What does that mean?

DECENTRALIZED

Well, decentralized means there is no one person controlling the blockchain. That is to say multiple parties are verifying the transactions that take place. Ethereum currently operates in a similar manner to Bitcoin in this way. There are more than 2000 nodes spread around the world securing and confirming transactions on the Ethereum network.

OPEN SOURCE

Open source signifies that the software on which Ethereum runs is available for everyone to use, modify and change. Anyone can do this for any purpose. Nobody controls the code for Ethereum, nor can there be any sneaky hidden features. It is all there in the open.

SMART CONTRACTS

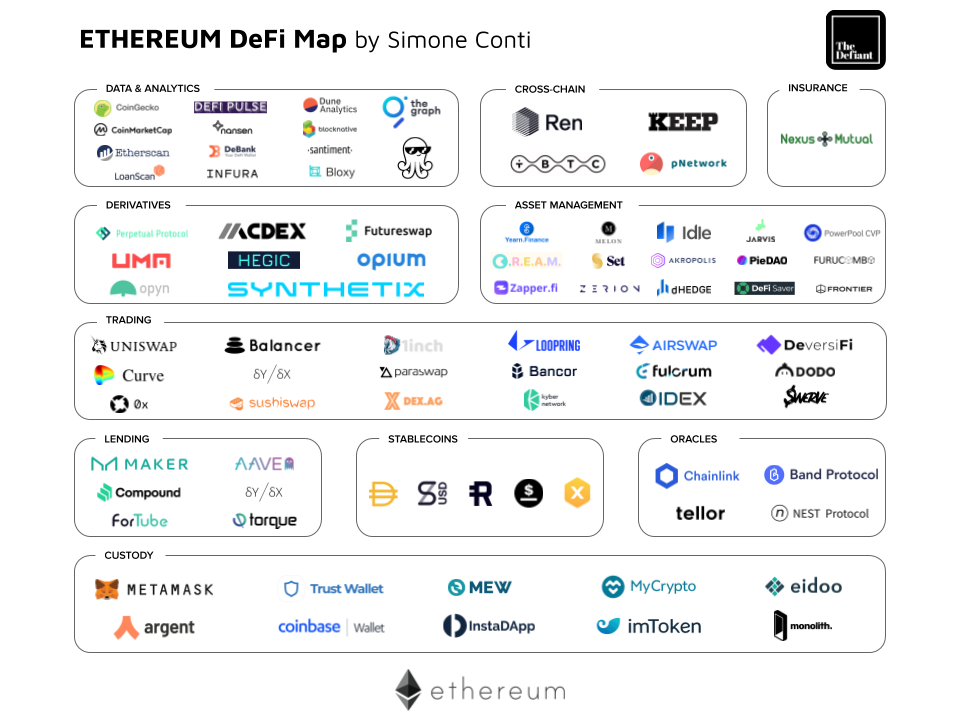

Lastly we come to ‘smart contract functionality’. This is important for Ethereum. Smart contracts are self-verifying as they have automated possibilities; they’re self-enforcing when the rules are met at all stages and finally they’re tamper-proof, as no one can change what’s been programmed. What you have then is a contract that can execute itself without a third party. The smart contract functionality of Ethereum is what makes it the popular choice for many DEFI (decentralized finance) applications. Contracts can be written to perform many of the similar services found in the traditional finance realms but without the need for a central authority.

DIFFERENCES BETWEEN ETHEREUM & BITCOIN

The smart contract functionality provides a significant divergence between Ethereum and Bitcoin. Though bitcoin does have some smart contract capabilities, they are not as complex or detailed as Ethereum’s. Hence, most Dapps (decentalized applications) are built on the Ethereum network. In short, Bitcoin is more akin to money or gold; a store of value. Ethereum is more like a complex software that you have to pay to use. You build something on it and then pay for the privilege of recording transactions and fulfilling contracts by buying Ether – the token that runs the Ethereum blockchain. The Ether is paid out by the Ethereum Protocol to miners/stakers who verify the blockchain.

SOME ISSUES WITH ETHEREUM

So what’s not to love about Ethereum and all the wonderful applications it enables. Quite a lot as it transpires.

SCAMS LOVE IT

To begin with it can be used for any purpose. Many of the projects that run on Ethereum are not really projects and can end up as rug pulls. This is when a token, much hyped, is rendered worthless as its liquidity is taken away by the creators of the token. Essentially they end up with the Ether or other coin of value, and you end up with a valueless coin. Of course this can happen with any chain and Ethereum is not to blame for bad actors.

COST OF USE

Secondly Ethereum is expensive to use. It can only do 30 transactions per second and this is obviously insufficient. It is hoped that with the Ethereum 2 upgrade this will be increased to 100 000 per second. However, currently, it is still not cheap to use Ethereum for everyday transactions. In addition, 100 000 transactions might well be too few for Ethereum were it to really be used by a lot of people in the future.

COMPLEX TO PROGRAM

Thirdly Ethereum is reputedly quite difficult to programme. That is to say, actually creating Dapps ( decentralized applications) is not easy to do. This might well mean that programmers and developers will migrate to other protocols which offer smart contract functionality.

IS THERE A “BETTER” ETHEREUM ?

Are there significant competitors for Ethereum?

The answer is yes. Solano has already become popular supports many of the projects that Ethereum does at a fraction of the cost. It also offers domains – .sol. These might be of interest in the future. The transactions per second are also much better than Ethereum. Around 60 000 per second. Though, again, this might not scale in the long term. There are layer one protocols that reputedly have TPS ( transactions per second) of a million plus. Radix is one such. Polkadot is also a contender. Its claim to fame is interoperability. A feature that allows blockchains that are different to ‘talk’ to each other. Cardano is another protocol that is old and venerable. However, it doesn’t seem to have developed as great a following as Ethereum.

Ethereum is still the most used of layer one protocols and has first mover advantage. It is debatable as to whether it can continue to hold its own in the sea of challengers. It will have to significantly improve in terms of TPS to be scaleable in the long term. We will see whether the current upgrading will bring a new dawn to Ethereum or a deepening gloaming.

For a simple video tutorial on Ethereum, you can watch the following from Binance.