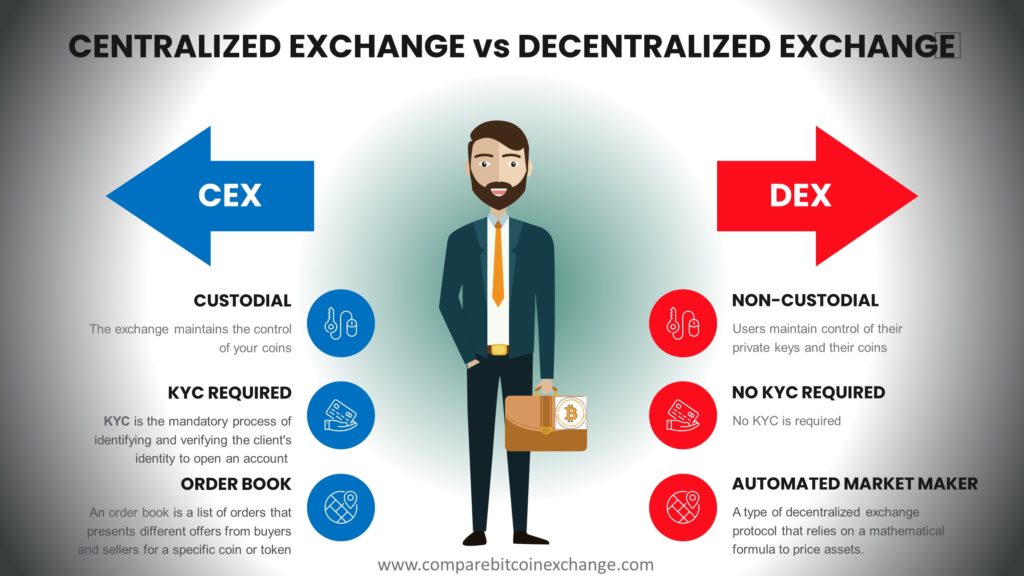

If you are just getting started with cryptocurrency and setting out to join an exchange to buy your first cryptocurrency, then you may have come across the terms DEX (Decentralized Exchange) and CEX (Centralized Exchange), but what is the difference and which one is right for you? In this short article, we will attempt to explain in simple details the fundamental differences between them to get you started. In the effort to keep it concise and clear, we will focus on the three key points of: –

- Custody,

- KYC (know your customer)

- Order Method.

THE DIFFERENCE BETWEEN CENTRALIZED AND DECENTRALIZED EXCHANGES

WHAT IS A CEX?

But first, simply what is a CEX? A CEX or centralized cryptocurrency exchange is the type of exchange that most people would use. Think of it as a business not unlike a stock brokerage in many ways. It is a place (website) where you can exchange your Dollars, Pounds, Euros or whatever for your favourite cryptocurrencies. Some of the best know centralized exchanges are Coinbase, Binance and FTX. As its name implies, it is centralized. That is to say it is administered by individuals who ultimately have control over the funds and deposits that are on the exchange. In this regard it is like a bank. They could stop your funds from being withdrawn or prevent you from depositing funds.

WHAT IS A DEX?

A DEX, or Decentralized Exchange is a peer-to-peer marketplace where transactions of cryptocurrencies can occur directly between cryptocurrency traders. These transactions do not rely on a central entity to control them. The trades are automated by smart contracts. That is to say your bid for a coin is matched by an offer. There is some complexity in how this is actually achieved – it is done with something called AMMs (automatic market makers) and LPs ( liquidity pools) – but the actual mechanics are beyond the scope of this simple guide. The key takeaway here is that no one is actually controlling the exchange and the contracts are executed by the code which cannot be prevented from occurring by a central authority.

SO WHAT ARE THE 3 MAIN DIFFERENCES ?

1. Custody

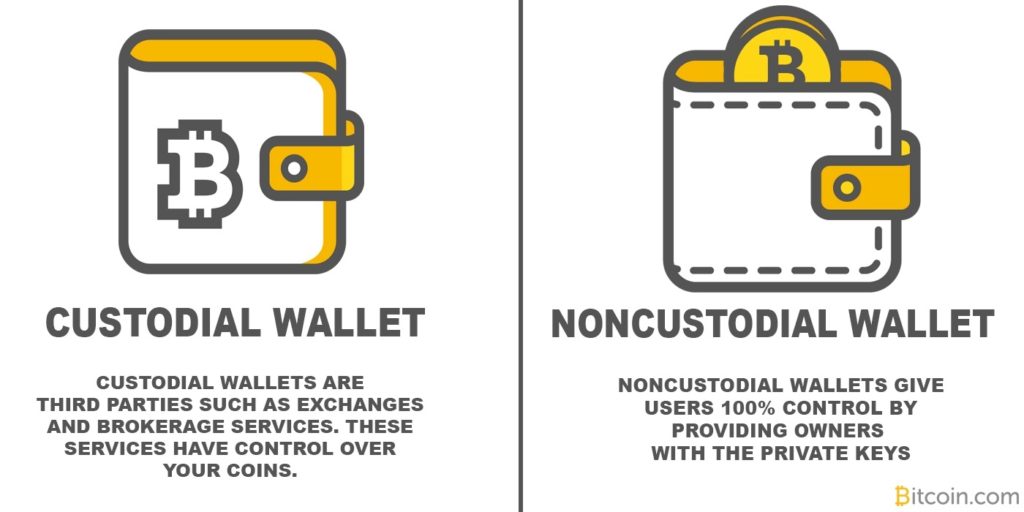

With a CEX (centralized exchange) your coins are held for you by the entity which controls or manages the exchange. Many, if not most, exchanges are reputable and reliable. Nonetheless, ‘not your keys, not your coins’. Ultimately your coins are controlled by someone else. There have been instances in the past of exchanges going broke, losing coins, or simply acting fraudulently. If you wish to keep full control of your coins, you might not want all your wealth on a centralized exchange.

With a DEX ( decentralized exchange) your coins are tradable from your own wallet. For example if you have a metamask wallet (see article on Metamask), you connect to a DEX -uniswap for example – and then, if you are happy with the pricing, approve the transaction. No middlemen are involved in this exchange. It is you, a smart contract, and the buyer. Your keys and your coins.

2. KYC ( Know Your Customer)

CEX – Centralized Exchanges

Increasingly the centralized exchanges are demanding KYC from those who apply to join them. Often this is not an option for them, as they are in jurisdictions that legally enforce such an action. Given the nature of Crypto some users may find this irksome. However, it is becoming more and more difficult to trade on CEXs without complying with KYC. It is more than likely that you will have to provide the exchange with documents and photos to prove who you are before you can start to trade.

DEX – Decentralized Exchanges

Decentralized exchanges (mostly) do not require any KYC ( know your customer). Assuming you have some Ethereum or Bitcoin or any other token/coin supported, you can go ahead and trade.You simply go to the decentralized exchange website that you choose and you will need to authorize to connect it to your wallet. Of course, you may not find it so easy to get back into fiat currency if you only use DEXs, but there are ways to sell peer to peer for cash if you need fiat currency.

3. Order Method.

CEX Centralized Exchange

With the centralized exchange you simply log into your account and place an order or a bid. The key point here is that you can vary the order or bid. It can be a market order, or limit order or, with exchanges such as FTX ( see article) you have even more complex parameters.

In short you have some control over your order. In addition you can see the order book and the depth of the market. These things might give you some indication as to what kind or order to place and what quantity. Centralized exchanges offer a more sophisticated set of options for traders of cryptocurrency than decentralized exchanges.

DEX – Decentralized Exchange

Decentralized exchanges are simpler in terms of execution. For example in Metamask (see article) you can use the swap function and will then be offered a match for the tokens you wish to swap. Metamask supports many tokens that are EVM ( Ethereum Virtual Machine) compatible, so you have a quite a large choice. Should you wish, for example, to swap Ether for USDT, you simple key in the amount of Ether you want to swap and will be given an offer of the USDT that corresponds to that amount.

You will be asked to review offer and then given time to decide. Metamask also takes a small percentage as commission but YOU ARE ALSO LIABLE for the cost of the smart contract to execute the trade. If you are exchanging small amounts this can be a pretty large percentage of your transaction. Decentralized exchanges offer a very simple method of exchanging coins on a supported network. They do not always give the best rates, but they are simple, fast and accessible.

SUMMARY

Centralized and decentralized exchanges offer different advantages and disadvantages. Many would argue that a mix of the two is ideal. Their strengths are different, they are useful for different things. As with all things crypto, proceed with caution and look carefully at the exchange you choose.